Canada made a sudden and dramatic policy reversal, announcing that tariffs on Chinese electric vehicles would be slashed from 100% to just 6.1%, alongside the opening of an annual import quota of 49,000 vehicles. The decision, unveiled during Prime Minister Mark Carney’s visit to China, immediately reshaped the trade landscape that had been dominated by U.S.-led containment efforts. For Canadian consumers, it means savings of up to 15,000 Canadian dollars on vehicles such as those produced by BYD. For policymakers, it reflects a high-stakes bargain often described as “electric cars for canola oil”.

After following Washington in imposing a punitive 100% tariff in 2024, Canada has now returned to 6.1%, effective immediately and covering both fully electric and hybrid models. The 49,000 vehicle quota is based on Canada’s 2023 import volume and is designed to cap, rather than block, Chinese EV access. In parallel, China committed to sharply reducing tariffs on Canadian canola oil, from as high as 84-100% down to 15% by March 1, and to easing restrictions on products such as lobster and beef.

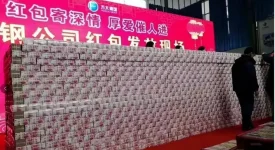

Canada’s earlier decision to align with U.S. policy triggered swift and targeted retaliation from Beijing, most notably a 100% tariff on canola oil. The impact was devastating for Saskatchewan, Canada’s largest agricultural province, where export revenues reportedly collapsed by more than three quarters. Farmers were left sitting on more than 3 billion Canadian dollars’ worth of unsold canola, pushing the Western agricultural economy to the brink and sparking tractor protests across the country. At the same time, U.S. pressure intensified rather than eased. The Trump administration in 2025 imposed additional tariffs of up to 35% on Canadian goods, even floating rhetoric about Canada becoming a “51st state”. With roughly three quarters of Canadian exports dependent on the U.S. market, Ottawa found itself squeezed from both sides.

The 100% tariff on Chinese EVs effectively doubled prices, pushing affordable models out of the market and driving some electric cars close to 80,000 Canadian dollars. Consumers faced higher costs just as farmers saw their incomes evaporate. The new arrangement attempts to address both crises at once. Lower EV tariffs are expected to bring prices back down by 30 to 40%, making models like the BYD Seagull accessible to ordinary households again. For agriculture, restored access to the Chinese market could recover an estimated 3 billion U.S. dollars in losses and stabilize rural livelihoods.

Beyond immediate relief, the deal hints at longer-term industrial cooperation. Chinese firms have signalled interest in expanding investment in Canada’s EV and battery supply chains, including the possible enlargement of BYD’s electric bus operations in Ontario. Such cooperation could help Canada advance its zero emissions transition while creating local jobs, though it also raises questions about competition with North American and European automakers.

Canada is the first G7 country to dramatically roll back tariffs on Chinese electric vehicles, openly challenging Washington’s approach. Carney’s remark that China is “more predictable than the United States” showed the depth of frustration in Ottawa and exposed fractures within the Western alliance. The U.S. may yet respond through mechanisms such as the USMCA or new steel and aluminum duties. At the same time, Canada’s pivot adds momentum to existing dissent within the West. Germany has criticized EU plans to raise EV tariffs, France has spoken of “strategic autonomy”, and other middle powers are reassessing the costs of rigid alignment. As emerging economies and BRICS countries expand direct trade links, the dominance of G7-centric rules and even the dollar-based system faces incremental erosion.

The policy is not without risks. Because the announcement was made by Carney in a special envoy capacity, opposition parties may challenge its legal standing if the prime minister’s office does not provide full backing. The allocation of the 49,000 vehicle quota remains unclear, raising the possibility of disputes if Chinese brands capture a large share. Technical hurdles also remain, particularly the need to adapt EV battery performance to Canada’s extreme cold.

Confronted with U.S. security pressure on one side and deep economic dependence on China on the other, Canada has chosen pragmatic survival over ideological alignment. The abrupt tariff reversal is both an act of self-rescue after an agricultural crisis and a telling example of how midsized countries are trying to carve out room to maneuver in an era of intensifying great power rivalry.