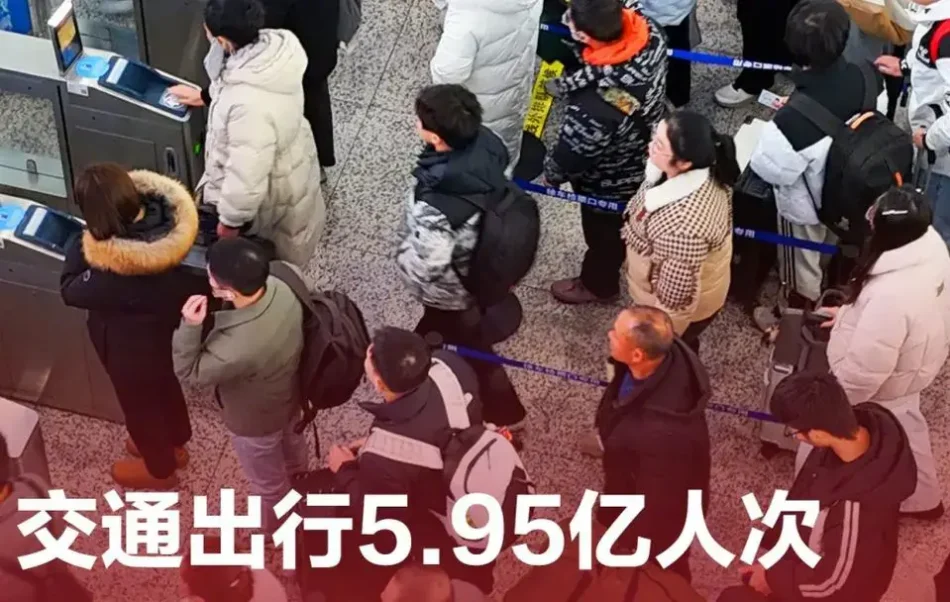

China’s 2026 New Year’s Day holiday delivered a powerful snapshot of economic vitality, with record-breaking mobility and tourism figures. During the three-day break, cross-regional passenger trips reached an unprecedented 595 million, while domestic tourism recorded 142 million trips nationwide. These numbers not only set new historical highs but also underscored the strong rebound and transformation of China’s consumption landscape.

Average daily cross-regional trips hit 198 million, up nearly 20% year on year, and January 1 alone saw more than 208 million trips. Railway passenger volume exceeded 48 million, and cross-border travel reached 6.615 million trips, marking a 28.6% increase. At the same time, domestic tourism spending climbed to 84.789 billion yuan, translating to about 597 yuan per traveller on average. Major economic hubs led the way: Shanghai generated 12.271 billion yuan in tourism revenue, Guangdong welcomed 17.875 million visitors, and Nanning leveraged large-scale concerts to boost tourism income to 3.29 billion yuan.

Tourism demand showed a clear “dual-track” trend, with northern ice and snow destinations and southern warm weather resorts both booming. Harbin Ice and Snow World saw its popularity jump dramatically, while Xinjiang’s Altay Prefecture reported double-digit growth in visitor numbers. In the south, Sanya experienced a fivefold increase in inbound tourists, with duty-free shopping helping to double hotel bookings.

Younger consumers played a decisive role in shaping demand. Post 2000s consumers accounted for roughly 39% to 52% of spending, driving the rise of what many described as an “ritual-driven economy”, where fireworks displays, concerts, and countdown events became travel motivators in their own right. The idea of “travelling for a single performance” gained traction, exemplified by Nanning’s hotel bookings increasing by 17 times. Meanwhile, consumers born in the 1980s and 1990s tended to favour family trips, while younger travellers experimented with flexible leave arrangements, longer stays, and “reverse tourism” to less crowded destinations.

Online platforms played a growing role, with short video apps reporting triple-digit growth in supermarket group vouchers, and AI increasingly used to manage crowd flows at popular attractions. In several regions, infrastructure came under pressure as extreme weather and overcrowding forced temporary closures at scenic sites, such as Chongqing’s Nantian Lake. Return travel costs spiked in popular destinations like Sanya, where flight tickets exceeded 2,000 yuan, and long queues formed at highway charging stations for electric vehicles.

Some analysts warned that comparisons with 2025, when the New Year’s break was only one day, may exaggerate growth rates, and that a fuller assessment should incorporate 2024 data. Others urged restraint in citing dramatic popularity increases for specific attractions when figures come from non-official sources.