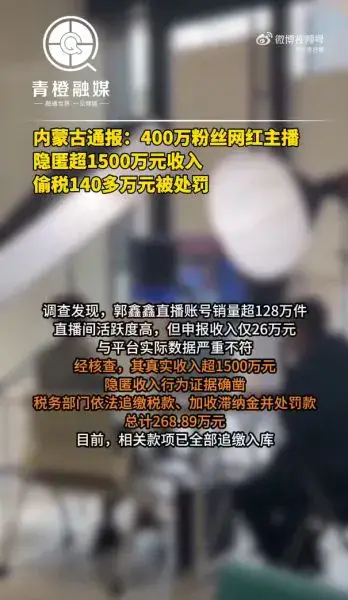

When the Inner Mongolia streamer Guo Xinxin 郭鑫鑫 insisted she had earned only 260,000 yuan over two years, a tax investigation revealed that she had actually hidden more than 15 million yuan in income. The nearly sixty-fold gap exposed widespread tax evasion in the livestreaming industry and triggered heated public criticism about tax fairness.

The case showed how far some creators go to conceal income. With four million followers, Guo made more than 15 million yuan from livestream sales and online courses between 2020 and 2022, but reported only 260,000 yuan, hiding 98.3% of her earnings. After refusing to cooperate, she was ordered to repay taxes, late fees, and penalties totaling 2.6889 million yuan. In another case, a clothing shop sold 1.84 million items in three years but paid only 36 yuan in taxes; after investigation, authorities collected 6.6958 million yuan in back taxes and fines, far more than rumours had suggested.

These cases illustrate the common tactics used to evade taxes. Many streamers receive payments such as commissions, gifts, and sales revenue directly into personal bank accounts to avoid platform and tax oversight. Others split income across multiple sole-proprietor accounts registered under relatives to classify personal labor income as lower-tax “business income”. Some MCN agencies fabricate “technical service fees” to shift revenue, including one company that issued nearly 1,200 fake invoices involving 226 million yuan.

Regulation has tightened sharply. In 2024, tax authorities investigated 169 streamers and collected 899 million yuan in back taxes. They now use a “five-step” method, warnings, corrections, interviews, audits, and public exposure, combined with rules taking effect in October 2025 that require internet platforms to report creators’ income. This creates full-chain monitoring that makes hiding earnings increasingly difficult. The cost of breaking the law is rising as well: in addition to repaying taxes, offenders face fines worth 0.5 to 3 times the hidden amount and daily late fees. Those who do not settle their first violation on time may face criminal charges and up to seven years in prison.

Behind the headlines is an industry marked by deep inequality. Top streamers can earn extraordinary sums, some receive over a million yuan in gifts in a single session, and guild competitions can generate tens of millions in one night. But 95.2% of streamers make less than 5,000 yuan per month, and only 0.4% earn more than 100,000. Many small creators struggle with equipment costs, revenue sharing that can take 30% to 50% of their income, and heavy personal income taxes.

Public anger has intensified over the contrast between ordinary workers who pay their taxes and high-earning streamers who try to evade them. Stories such as a student spending nearly 2 million yuan on streamer gifts, while many professionals earn less than 10,000 yuan a month, highlight the growing sense of unfairness. For many, tax evasion by influencers is seen as a direct challenge to social justice.

As scrutiny grows, the industry is being pushed toward compliance. Streamers are learning that traffic is not a shield, it comes with a responsibility to pay taxes. Under new regulations governing livestreaming e-commerce, the cost of evasion far outweighs the benefits, as penalties can reach twice or three times the amount of hidden income. The public is also calling for platforms to take greater responsibility by withholding and remitting taxes directly, and to monitor attempts by influencers who return under new accounts.

While top creators can earn vast sums, the reality is that most struggle to survive. Paying taxes is a basic obligation, but building a healthier and fairer revenue system may be the deeper solution needed to address the tensions in this rapidly growing industry.

Netizens in China reacted:

“Livestream shopping platforms have a duty to supervise tax filing or provide income information.”

“Beauty influencers are the hardest hit.”

“The platforms carry a lot of responsibility.”

“Where does all this money even come from? I didn’t know people could make this much.”

“I would never send big gifts to streamers, they already earn too much.”

“Why don’t the platforms regulate them? Because the platforms take half of the revenue.”

“In the era of social media, influencers really do make a lot of money.”

“Off-platform private deals are an even bigger problem.”

“They earn so much. It makes manufacturing work feel painfully hard by comparison.”

“Livestreaming really is profitable.”

“Finance and accounting professionals become accomplices.”

“You’re the ones who made them rich.”

“Strictly investigate influencer income.”

“No wonder an influencer can buy a ten-million-yuan house in just a few years.”

“Meanwhile, lifelong hardworking farmers are left wondering how this is fair.”