A few weeks ago, Nvidia CEO Jensen Huang made tech headlines with the opinion that China is nanoseconds behind the USA in its chipmaking ability.

Nvidia is the global leader in AI chips currently, as reflected by their ballooning stock price over the last few years. Employees of Nvidia have become so rich off the stock, it’s a struggle for Nvidia just to keep core members of their team employed. But China is challenging this top American company in their domination of the market.

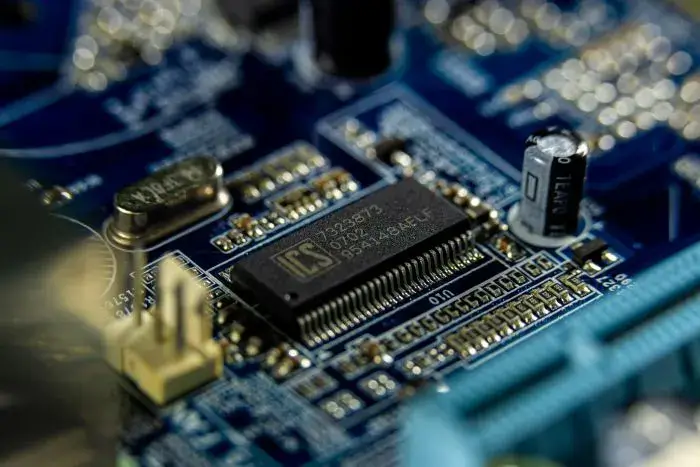

AI demand is surging, and whilst many consider this simply being the AI bubble growing larger and larger before it pops, it nevertheless indicates that AI is one of the main competitions between the great powers in this current era. The race to generate the most powerful AI involves producing the semiconductors that make AI able to compute.

Beijing made headlines last month by freezing Nvidia’s access to the growing Chinese market. They’ve prohibited major tech firms in China from buying AI chips, reflecting China’s confidence in their domestic market’s ability to meet needs, and in order to shove out American dominance in their markets.

However some analysts believe this is part of a wider strategy in having something to negotiate with the US over the Trump administration’s new tariff system. It was only a few months ago that Nvidia sales of certain chips were resumed after a halt in their exports to China. This back and forth between China and the US’s import/export arrangements has been causing constant uncertainty in the markets involved.

Jensen Huang’s comments likely come as a sort of rallying cry towards the US market forces, to spread fear and to call them to invest more in his company, which according to certain technical trends is overvalued due to the AI hysteria and probable investment bubble. He is well known to make exaggerated claims in order to influence the company’s image, and draw more support.

Some consider his comments to be a bit of an exaggeration, considering China is, according to some experts, still 10 years behind places like Taiwan in their chip-making abilities. But others see that China has quickly caught up with other countries in this technology and has even surpassed many tech leaders in some areas of chip design.

He also noted that “What’s in the best interest of China is for foreign companies to invest in China, compete in China and for them to also have vibrant competition themselves.”

“They would also like to come out of China and participate around the world.”

After all, 65 of the top 100 AI experts in the world are Chinese, and many highly educated and experienced Chinese tech experts are being lured back to China to work from abroad after suffering funding neglect and racism in the West. As the Western world continues to destabilize and China increases its lead in tech and overall stability, it’s clear that China as a work place is now more lucrative for the top experts in various fields.

It’s only a matter of time before China does catch up to companies like Nvidia, because there likely is a ceiling to this technology before the next major breakthrough is discovered. This recent development cycle of AI chips is possibly a stepping stone towards creating a true AGI (Artificial General Intelligence), which would give the first country to discover it the biggest advantage in human history over the rest of the world, far more influential than even the atomic bomb was.